Beaufort Financial Forth Valley is an independent Financial Adviser that offers sophisticated and transparent financial advice to individual clients and private companies.

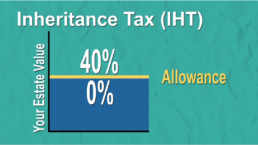

Making plans today to ensure your wealth and assets remain in your family, with future inheritors being protected, is what we refer to as estate planning. Inheritance tax (IHT) planning becomes part of the wider estate planning exercise.

Beaufort Financial is here to help you plan in several ways:

- Working with your other professional advisers (solicitors/accountants) to optimise the estate and tax-planning aspects of your Will

- Advising you on the various tax implications involved in giving lifetime gifts

- Reviewing your pension provision and suggesting ways to improve its role in your estate planning

- Arranging investments and life assurance to help reduce or fund IHT

- Helping you to understand how trusts work

- Advising you on any relevant insurance or protection plans to cover you, should you need

- Reviewing your current protection/insurance policies.

We can help you find the best solution, that’s right for your situation. We also offer a free no-obligation initial consultation to discuss your financial needs.

Videos

Client tax guides

You and yours – estate planning

Estate planning is usually not a subject that attracts immediate attention. It requires you to consider what will happen when your life is over, hardly something most of us rush to contemplate. Consequently, estate planning often becomes a do-it-tomorrow task. Then it could suddenly become all important… or it might be too late.

Financial protection – for you and your family

Financial resilience is the ability to recover quickly from an unexpected financial shock. Many of us insure our homes and cars without really thinking about it, but far fewer insure their lives and incomes. Savings can and do help in the short-term. But what happens when they run out?

Investing for children

Most parents want to help their children financially, whether it is making sure there is enough money for their education or eventually helping them to buy a property. An early objective as they grow up may well be to help children understand the value and importance of money.

Taxation of property

Becoming a landlord has been an attractive proposition for anyone who could raise a deposit, thanks to a prolonged period of low borrowing costs and generally rising property values. Uncertainty in the housing market may reduce property prices whilst capital gains tax (CGT) changes may occur.

Sign up to our newsletter

Read our monthly newsletter full of useful financial tips and advice.

I just wanted to thank you for your continuing financial advice. My requirements are always dealt with in a very professional, yet friendly & helpful manner. I am impressed with your obvious expertise, the thorough background work & your ability to explain clearly the ‘pros & cons’ of any investment strategy, which is essential guidance for decision making.C.Smith, Falkirk

Douglas has given us excellent service since we became clients of his. He & his staff have an attention to detail & a true, friendly customer focus which we really appreciate. Douglas really understands his business & takes the time to discover what you want from your investments. He is always on hand to offer advice & answer questions.B.Paterson, Falkirk

We have worked with Dougie Harley for over 20 years & have never considered taking our business elsewhere. In fact, we have recommended his services to family & friends, all of whom have been delighted with the quality of the firm’s advice, support & knowledge. M.Carson, Falkirk

Inheritance tax was a big worry for us, as was ensuring our assets passed on to our family in the way we wanted. The strategies put in place by Douglas & his team have given us the peace of mind we require on both issues. If you have Inheritance tax worries, this is the team to speak to.C.McLuckie, Falkirk

Douglas & his team are great at building personal relationships & providing more than just financial advice. They are confident, professional & approachable, which is exactly what you need when it’s your money they are looking after.I.Cooper, Falkirk

I have known Douglas before he set up business himself. He is friendly, honest, trustworthy & a true professional. I trust him implicitly. He is always thorough - he always keeps a confidential complete record of details updates them so that he can assess the financial picture accurately. He never sells anything or recommends products unless it is what is either requested or needed.F.Sutherland, Glasgow

We have been clients of Douglas for nearly 20 years & have always received a first class service from him & his team. We would have no hesitation in recommending him to friends, family & colleagues.L.Wight, Glasgow

As a business owner, it is important to me that my financial plans are tax efficient & flexible enough to adapt to my changing needs. Douglas listened to what was important to me & built my wealth management strategy around this. I would not hesitate to recommend Douglas to my friends & family.M.Smith, Falkirk