What is a Pension and Pension Questions

The author of this blog is Ashley Hull.

‘59% of working adults said their lack of understanding of the (pension) system puts them off saving more into a pension.’

‘Fewer than 50% of people in the UK are saving enough for retirement.’

Pension Definition

A tax efficient way of saving for your retirement. Imagine it as a long-term savings account.

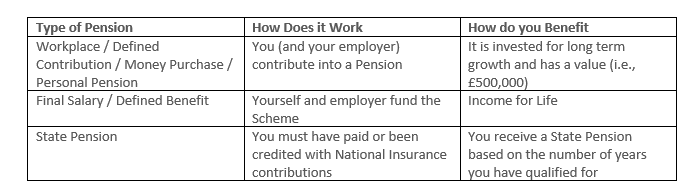

What Different Types of Pensions Are There?

Do I receive tax relief on my contributions?

- If you make Personal Pension contributions, you receive tax relief on these – the idea being you do not pay the tax on money that goes into a pension

Example

- Person Earning £35,000 per year (Basic Rate Taxpayer) contributes £100 per month personally. This will receive an additional £25 and be added into the pension.

How is my pension invested?

- Pension can be invested into a wide variety of options

- Cash & Cash Funds

- Investment Funds

- These can be sector specific i.e., North American Equities or Global Funds

- Property

- Via Funds

- Real Estate Investment Trusts

- Direct Commercial Property Holdings

- Shares

- Companies that make up the Stock Exchanges

How do I Withdraw my pension (Workplace / Defined Contribution / Personal Pension)?

- Tax Free Cash and Drawdown

- You receive 25% of the value as a tax-free cash payment

- The rest is used to provide you with income

- You can choose how much income you receive

- These payments are added to your income tax liability

- Take It All in One

- 25% of the withdrawal will be tax free

- The remaining 75% will be added to your income tax liability

- Buy an Annuity

- This is where you give your pension to a Life Insurance Company who then pay you an income for life

What Happens to my Pension when I Die?

- Workplace / Defined Contribution / Personal Pension

- You have the choice of nominating beneficiaries who will receive the pension

- It can be a great planning tool to pass on money to partners, children, grandchildren etc.

- Check if your pension offers Dependents Drawdown – otherwise there could be some avoidable tax consequences for your chosen recipients

- Defined Benefit Pension

- This is scheme specific but usually 50% of the income will be paid to a spouse / dependent beneficiary and children are usually included

If you would like to discuss your financial goals further or another financial planning matter please get in touch with Ashley Hull, Ashley.hull@beaufortfinancial.co.uk or via mobile: 07741 242151.