Beaufort Financial Westerham is an independent Financial Adviser that offers sophisticated and transparent financial advice to individual clients and private companies.

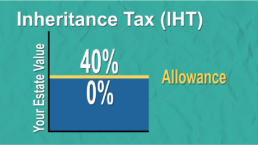

Making plans today to ensure your wealth and assets remain in your family, with future inheritors being protected, is what we refer to as estate planning. Inheritance tax (IHT) planning becomes part of the wider estate planning exercise.

Beaufort Financial is here to help you plan in several ways:

- Working with your other professional advisers (solicitors/accountants) to optimise the estate and tax-planning aspects of your Will

- Advising you on the various tax implications involved in giving lifetime gifts

- Reviewing your pension provision and suggesting ways to improve its role in your estate planning

- Arranging investments and life assurance to help reduce or fund IHT

- Helping you to understand how trusts work

- Advising you on any relevant insurance or protection plans to cover you, should you need

- Reviewing your current protection/insurance policies.

We can help you find the best solution, that’s right for your situation. We also offer a free no-obligation initial consultation to discuss your financial needs.

Videos

Client tax guides

You and yours – estate planning

Estate planning is usually not a subject that attracts immediate attention. It requires you to consider what will happen when your life is over, hardly something most of us rush to contemplate. Consequently, estate planning often becomes a do-it-tomorrow task. Then it could suddenly become all important… or it might be too late.

Financial protection – for you and your family

Financial resilience is the ability to recover quickly from an unexpected financial shock. Many of us insure our homes and cars without really thinking about it, but far fewer insure their lives and incomes. Savings can and do help in the short-term. But what happens when they run out?

Investing for children

Most parents want to help their children financially, whether it is making sure there is enough money for their education or eventually helping them to buy a property. An early objective as they grow up may well be to help children understand the value and importance of money.

Taxation of property

Becoming a landlord has been an attractive proposition for anyone who could raise a deposit, thanks to a prolonged period of low borrowing costs and generally rising property values. Uncertainty in the housing market may reduce property prices whilst capital gains tax (CGT) changes may occur.

Sign up to our newsletter

Read our monthly newsletter full of useful financial tips and advice.

Thank you Paul for visiting my home recently for a dig through our various life insurance policies. I left my wife to run the meet and greet and she was very impressed with Paul's analytical approach, obvious knowledge and professional yet friendly manner. We were very happy that Paul was able to advise us on a type of cover we should be looking for and presented us with option on policies that were much more useful and with much cheaper premiums. Paul even made the form filling as simple as possible and for that we are grateful.The Gibsons

I was extremely pleased with Iain Parkhouse's service and have no hesitation in recommending and referring his services. If you have not spoken to him recently, I would strongly suggest arranging a review with him.Denni Jackson, Sales & Marketing Director, Drifters Travel

I have known Iain Whitechurch for over 10 years now and he always provided me with expert advice on my investments and mortgages. He is a true expert in his field. Iain's knowledge and experience is backed by his pleasant and professional approach. Iain always listens, he understands well what I am trying to achieve and he works in a very timely and efficient manner. Nothing is too much trouble for Iain. I wouldn't hesitate to recommend his services and indeed I have to a number of my friends.R Thompson, M.D. London

Iain has spent quality time with me to understand my situation, my preferences, and my approach to investments. He has a great way of explaining things, and de-mystifying the most complex of matters and distilling it into something very easy to comprehend so that you can make informed decisions over your own financial affairs. Whatever your level of understanding and financial experience, he will adjust his approach and tailor it to suit your individual needs, taking time to be sure you are fully up to speed with whatever you are reviewing. Having worked with a number of IFAs in the past, I now feel totally at ease and confident working with Iain on an ongoing and regular basis to navigate the minefield of professional financial advice and financial services.S Khadka-Lowe, Director. Cobham

For almost 20 years I have used the services and advice from Iain Whitechurch, the services offered included, mortgages and re-mortgages, children's saving plans and pensions in the main. The advice was always given at a level that was understandable and appropriate for my financial situation at the various times though out the last 20 years, which due to unforeseen circumstances has been ever changing. Along with the expert advice and service Iain has become an integral part in my financial future plans and decisions. He has also offered this same advice to my now adult children as they have always known him and trust his ability and advice. I have no reservations about recommending his services to family and friends, his friendly yet professional approach make dealing with financial decisions a less stressful experience.A Scutt, Specialist Nurse Manager, Copthorne

Every quarter I get information on how my investments are performing in relation to other investments in the portfolio in addition I can look up on the web to see how my interments are performing in their own right on a daily basis. Thanks to Felix I now have greater confidence in my financial future and I look forward to doing more business with him in the not too distant future. Calum Shaw

Gerard is a highly professional and knowledgeable financial adviser who I would unquestioningly recommend to anyone for advice and help. Picture him as an intrepid jungle guide, cutting a swathe through an otherwise thick, uninviting and seemingly tangled financial world and you won't go far wrong. He's helped my wife and I for a number of years and remains our go to adviser.Andy Cutbill, Co-Founder of Mr Bridger, ECD at ?What If! Innovation Partners

Having used Brian's services on several occasions for myself, my friends and various colleagues I declare myself a great admirer of his professionalism and knowledge. And an all-round nice guy! If you are looking for an IFA - look no further, you've found the best one.Dallas Van Renselar

Iain is an honest guy who cares about the service he provides to his clients. His advice is always clear & well thought through.Stuart Gilbert

I gladly recommend Iain for his work as a financial adviser for me and for many other people I know within our network of friends and business colleagues. Above all, his knowledge of what is available and his expert opinion and advice has been, and continues to be completely reliable. I believe Iain delivers top quality as a person and within his business.Gerry Boniface, Sales Leader

I first hired Felix in April 2011 to arrange my critical illness cover. Now I am notoriously hard to pin down to arrange stuff like this due to my constant work load. Felix was totally understanding of this and his incredible perseverance with me resulted in finally securing an excellent policy for me in March 2012. Felix visited me at my workshop on a number of occasions to gain all the relevant information that he needed. I cannot thank Felix enough for his hard work and patience and will be glad to recommend him in the future. And he makes a damn fine cup of tea as well!Richard Wallage