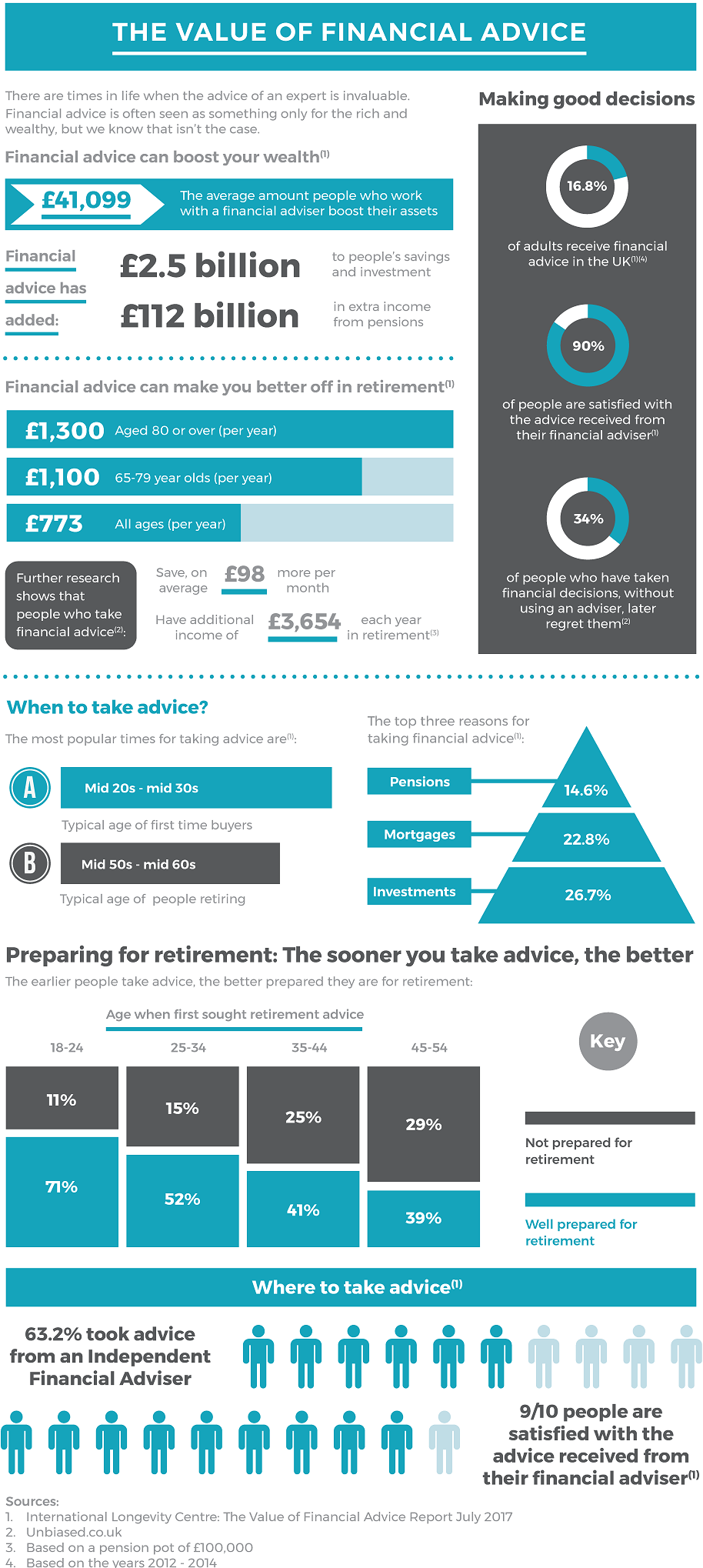

Infographic: The value of financial advice

There are time in life when the advice of an expert is invaluable. Financial advice is often seen as something only for the rich and wealth, but we know that isn't the case.

Click here for a copy of the value of advice infografic or a printable copy here.

Taxation of UK Investment Bonds on Divorce

UK Investment bonds are quite a common type of investment held by individuals and as such you may come across them from time to time when settling financial matters on divorce.

What you need to know:

Importantly, they are not 'qualifying' policies for UK tax purposes. This means a chargeable event can arise at any time, with tax being payable when a gain is calculated on a chargeable event. The following are the most typical chargeable events:

- Death giving rise to benefits;

- Assignment of all rights under the policy for money or money's worth

- Maturity (if appropriate)

- Certain part surrenders and part assignments

- Policy loans

- Surrender of all rights under the policy

It may be that a full surrender of on investment bond is the outcome as part of a financial settlement. The potential problem, here, being that a tax liability may arise when it could be avoided.

This is because an assignment that is not for value (ie. not for 'money or money's worth') does not trigger a chargeable event. Therefore, gifting a bond does not create a chargeable event. This provides tax planning opportunities.

Specific assignments which are not for money or money's worth include assignments in connection with divorce:

- An assignment is not for money or money's worth where the Court has made an Order:

- Formally ratifying an agreement reached by the parties that deals with the transfer of assets including the policy, or

- For ancillary relief under the Matrimonial Causes Act 1973 (or financial provision under the Family Law (Scotland) Act 1985) which results in a transfer of rights under the policy from one spouse to another.

There will be a Court Order for almost every divorce or dissolution involving property and so it may be that an assignment as opposed to surrender may prove to be a more tax beneficial outcome, especially of the parties to a divorce pay tax at different rates.

Where the life office knows that an assignment has taken place as part of a divorce or dissolution settlement, it is entitled to assume that the assignment was not for money or money's worth. This means that no chargeable event certificate will be issued

Defined benefit pension transfer: is it worth it?

When it comes to saving for retirement, most people working within the private sector are likely to have a defined contribution (DC) pension. This essentially provides you with a savings pot you pay into throughout your working life; these savings grow over time through compound interest and tax relief and are, in most cases, only drawn upon once you retire.

However, those working in the public sector, such as the NHS, the police and state education, instead have a defined benefit (DB, also known as Final Salary) pension which works under an altogether different system. Rather than a pension pot which is paid into by you, DB pensions depend upon three factors: your pensionable service, calculated through how long you have been a member of the pension scheme; your pensionable earnings, which is decided either through the salary you are earning at the point you retire, or the average salary you've earned during your membership; and the accrual rate of your scheme, which dictates the percentage of your salary you'll receive per year of service.

In the past, the DB pension schemes of the public sector were envied by those in the private sector. However, the introduction of pension freedoms last year has seen something of a reversal of fortune for those with DB pensions. Pension freedoms have allowed those with DC pensions to withdraw lump sums from their savings pot but as those in a DB pension scheme don't have a savings pot, they're unable to do this.

It's for this reason that some are now looking to transfer their DB pension to a DC pension scheme. For those in the public sector whose pensions come from taxpayers money and not a central fund (known as 'unfunded' schemes), this isn't possible, for the simple reason that the money isn't available to them until they retire. However, 'funded' DB pension schemes, such as local government pensions, are paid from a central fund and therefore can be transferred.

It's worth noting that transferring from a DB to a DC pension scheme will likely leave you with less money in your pension savings, as the amount you will be able to move is dependent upon the transfer value of your DB pension. Some employers do offer transfer incentives such as enhanced transfer values or cash payments, however, which may make transferring more attractive.

The main benefit of transferring is the ability to take advantage of pension freedoms, so if you have plans for what you want to do with a lump sum then taking a hit on your monthly pension amount for potential benefits later on can be worthwhile. If you don't have plans to take a lump sum, however, then remaining in your existing DB pension scheme may be the safer bet. Any decision regarding your pension should be taken with financial advice; for more information, please contact us.

Our four top tips for beating jet lag

With the summer months approaching, more and more people will be jetting off to sunnier climes to escape the infamously unreliable British weather and the prospect of a barbecue in the back garden doused in a sudden downpour. But international travel comes with its own problems, not least having to overcome considerable jet lag before you can enjoy what a different time zone has to offer.

With your body clock disrupted and your sleeping schedule out of synch, jet lag can lead not only to disorientation and exhaustion, but also to feeling considerably unwell in the most extreme cases. Thankfully, there are things you can do to beat jet lag, or at the very least reduce its impact, and help you get over it a little quicker.

- Adjust your sleep pattern before you depart - this can be easier said than done, but if you're able to change your sleep routine in the days leading up to your flight, either by going to bed later or getting up earlier than usual, it can reduce the shock to your system once you arrive. Sleeping on the plane is also a valuable option if you're able to do so. Eye masks, ear plugs and comfortable travel clothing can all help to make this easier to do.

- Include a stopover in your journey - stopping over somewhere as you travel to your final destination can be effective in helping your body to gradually adjust to being in different time zones. If you can leave the airport, take the opportunity to explore the local area but even if you can't, make sure you schedule in a revitalising activity to leave you feeling de-stressed and refreshed.

- Hydrate yourself - failing to stay hydrated often makes the effects of jet lag worse. That complimentary glass of wine or third cup of coffee, as well as the plane's conditioned air, will all work together to leave you dehydrated, so make sure you drink water regularly too. Bring an empty plastic bottle with you and ask the flight attendants to refill it for you throughout the journey.

- Break free of the airline's meal times - bringing your own healthy snacks for the flight will allow you to eat when you want, whilst eating light helps your body clock to adjust more quickly to the mealtimes in your new time zone. By the same token, a big meal mid-flight in the middle of the night can make your jet lag feel worse once you arrive.

Sources http://www.saga.co.uk/magazine/travel/travel-advice/how-to-beat-jet-lag

Wealth? Fame? Working hard? New research reveals what really makes us happy.

It's been 75 years in the making and the topic for countless philosophers to muse over, but a US study seems to have finally uncovered the secret to happiness and health.

Speaking during a TED Talk, Harvard professor Robert Waldinger revealed that, though wealth and fame continue to be commonly cited desires amongst millennials (those born sometime from around the early 1980s to around the year 2000), the research he presides over has found only one consistent factor: positive relationships.

https://youtu.be/8KkKuTCFvzI

During the twelve minute talk, Waldinger says that the data he and his colleagues have gathered indicates that people who are well connected to family, friends and communities are happier, healthier and live longer than those who are less well connected. People who are more isolated than they want to be suffer from shorter lifespans, see their brain function decline faster and generally experience lower health and happiness levels.

Other links between happiness and relationship status have also been uncovered. Whilst positive relationships can have a majorly beneficial impact on us, the reverse is true of negative relationships. The data gathered suggests that an unhappy marriage, for example, can have a more pronounced negative impact on the parties involved than the corresponding divorce would create.

So, maybe it's time to forget about your cholesterol levels, because Waldinger looked at those as well in the study's sample group when they were age 50 and found little link between poor results and happiness and satisfaction when they were 80. Those who had positive relationships at age 50, however, were also the happiest and healthiest individuals when they became octogenarians.

The message, of course, applies to us all and in many ways, but is particularly interesting for us to consider when it comes to our financial health and wellbeing. Great finances, well looked after and planned, allow us to focus on the important things in life; on nurturing those great relationships between ourselves, our connections, our partners and children. Keep working towards positive relationships and we'll keep your money working for you and those close to you. Here's to a happy, healthy future!

Will your pension be hit by the new lifetime allowance ?

A new lifetime allowance (LTA) was introduced on the 6th April 2016 restricting the tax-breaks on pensions. If the combined value of your pensions exceeds this allowance you could face additional tax charges.

What is the lifetime allowance?

This is the maximum sum you can build up in pensions and receive tax breaks on over your lifetime. This lifetime allowance includes both company and private pensions, such as defined contribution and final salary pensions. It doesn't include the value of your State Pension though.

How much can I have in a pension?

The LTA is now £1m, but it was £1.25m until 5th April 2016.

The government has said that from 2018 it will be increased each year in line with inflation, as measured by the Consumer Price Index (CPI).

Will my pensions exceed the lifetime allowance?

If you have a generous workplace pension or have saved significant amounts into personal pensions, it is worth checking the value of these pensions against the LTA to ensure you don't go over this limit.

This isn't always straightforward as the method used to determine the value of your pensions depends upon the type of pension arrangements you have and whether they are paying out yet or not:

■ Defined Contribution (DC) pension

This type of pension is often built up from personal and employer contributions that are invested over your lifetime to provide a pot of money for retirement.

Here you just need the total fund value, which can be found on your annual statement (you may wish to get an update depending on how old your statement is).

If you have more than one DC pension you need to add these totals together.

or advice.

Think about the future

If you are still several years from retirement, think about how these funds might grow in future and whether that means they could exceed the LTA. If so, you may want to consider limiting future contributions, although be aware that this may mean losing valuable employer contributions.

■ Defined Benefit (DB) pension

With these pensions, your retirement income is based on salary, and the length of time you worked for your employer. Rather than show a 'fund value', your annual statement shows the pension you are on track to receive at retirement.

For LTA purposes you need to multiply this annual pension by 20 to get the theoretical 'fund value'. So those on track for a pension of £18,000 a year, would be deemed to have a fund worth £360,000.

Many final salary schemes offer a tax-free lump sum, before income begins. This may be in addition to your full pension income or by reducing your pension income to provide the lump sum. The calculations can be difficult and we would encourage you to speak to your financial adviser.

■ Pensions already paying out

If you have started taking an income from a DC or DB pension since the LTA was introduced on 5 April 2006, you should have been assessed already. Your pension provider or financial adviser will be able to confirm the figure that was calculated.

If you were already in receipt of a pension before 5 April 2006 and have continued to save into other pensions since then where no subsequent lifetime allowance tests have been triggered, different rules apply:

- For final salary (DB) pensions the calculation is 25 times your current annual pension.

- For drawdown pensions the calculation is 80% of 25times your current annual drawdown limit. (drawdown or income drawdown is where you take income or tax-free cash from your pension and keep the remaining pot invested.)

This is a complex area and we would encourage you to discuss this with your financial adviser.

How much tax will I pay?

If, when tested, the value of your pension exceeds the LTA you'll face a tax charge on the amount that is over the limit. The exact charge will depend on how this excess is paid out.

- If the excess is paid out as lump sum it is subject to a 55% tax charge.

- If it is paid in the form of a pension income, this'excess'is subject to a 25% tax charge, in addition to the income tax charged on this pension. Remember taking this excess as income, on top of other earnings/pension income, can push you into the next tax bracket.

You can still put money into a pension once you exceed the LTA limit, but will face tax charges on this excess.

My pension could exceed the LTA. What do I do next?

Each time the government has reduced the LTA, it has set up various 'protection schemes' to safeguard those in this position.

There are a number of schemes in place, but in essence these give savers their own tailored LTA. The exact amount will depend on the value of their pensions when these new rules came into force and the protection they applied for. Savers have to apply to get this protection. If you don't you could be hit with tax charges.

You need to look at the terms carefully as in some cases you may not be able to make further pension contributions if you want to protect this higher LTA. This may require certain actions on the part of you, the individual, and should be considered ahead of the date the new lower LTA is introduced.

What are my options?

From April 2016 the government plans to introduce two new forms of protection that can be obtained.

Fixed protection 2016

This gives you a LTA of £1.25m, or the prevailing LTA, whichever is higher.

This effectively allows you to lock your LTA into the current, higher rate, but also means that if the LTA does increase again you will not be disadvantaged.

However, for this to be valid you cannot make further pension contributions or actively accrue further pension benefits in a final salary pension scheme, on or after 6 April 2016.

Individual protection 2016

Here, your LTA is set at the value of your pensions on the date the lower allowance is introduced (6 April 2016).

The value of your pensions must be between £1m and £1.25m

to qualify. Unlike Fixed Protection you can continue to make contributions, but any pension in excess of the relevant LTA will be taxed when tested.

Similar schemes operate from when the lifetime limit was cut from £1.5m to £1.25m in April 2014. Those whose pension fell between these limits at this date may still be able to apply for individual protection 2014.

How do I apply for the protection?

You can apply to HMRC after 6 April 2016. The latest information from HMRC is that there will be no application deadline for these protections. However, to rely on the relevant protection, you must apply before your pension is tested against the LTA and must have adhered to the relevant conditions. This applies even when the benefits being taken are worth less than £1 million. The application process is expected to be online from July 2016. If you wish to rely on protection ahead of July 2016 you should write to HMRC who will write back confirming protection status. A full application will still need to be made after July.

What to do if you need help?

If you would like to discuss this topic with us then please do not hesitate to get in touch.

Retirement plans on hold for many over 50s

A third of people aged over 50 who are employed in the private sector are now planning to retire later than they previously hoped, Aviva's latest Working Lives report reveals.The 2016 report - which comprises research among UK private sector employers and employees - has a particular focus on employees aged over 50, following the end of compulsory retirement and with the first anniversary of the 'pension freedoms' approaching.

In particular, the Aviva Report survey asked people what age they hoped they would retire at, before they turned 40. Now, aged over 50, more than one in three (36%) admitted they would be retiring later than they thought - by an average of eight years. Among those who will now retire later than hoped, the report found a variety of reasons for people to postpone their retirement plans:

- Not saving enough into a pension - 46%

- The amount available through the state pension - 32%

- I have debts to pay off (including mortgage) - 24%

- Feeling that I still have a lot to offer at work - 21%

- The level of enjoyment/satisfaction I get from my work - 20%

- My employer wants to keep me on - 13%

- Position of my partner - 13%

- I have children who need financial support - 8%

- I have elderly relatives who need financial support - 1%

- Other - 10%

- None of these - 3%

- Don't know - 2%

The Working Lives report also reveals a gap between employers' and employees' views on the impact of the pension freedoms, as the first anniversary of their introduction in April 2015 approaches. Over one in five (22%) employers think the freedoms could result in their employees having to work longer to make up for a shortfall in savings if they use part of their pension before retirement. At the same time, almost one in three (32%) employers are concerned they will lose valuable skills because people will retire earlier due to the freedoms.

However, these fears may be unfounded as the vast majority of employees aged 50 and above do not intend to alter their plans because of the pension reforms. Only 8% highlighted that the freedoms will result in them retiring earlier, contrasting with the concerns employers have around loss of skills. One in ten (11%) employees over the age of 50 now think they will retire at a later date because of pension freedoms, while 9% still remain unsure as to what the eventual impact of the freedoms will be upon their retirement plans. Seven in ten (71%) stated they have no plans to retire or that the pension freedoms have not affected their expected retirement date.

Aviva's Working Lives report also questioned 500 private sector businesses of different sizes about a number of issues, including how prepared they are to deal with changing retirement patterns following the scrapping of the Default Retirement Age and the introduction of pension freedoms. The findings suggest the majority of businesses do not have plans in place, and that they are less prepared for staff retiring later (just 25% have plans for this) than they are for staff retiring earlier (29% have plans in place).

Even among large companies (250+ employees), less than half (42%) have plans in place should their employees retire later than expected, compared to 14% across both small and medium sized businesses. Likewise, only 48% of large businesses have plans to cope with staff starting to retire sooner than expected, compared to just 17% of medium sized businesses and only 15% of small businesses.

With many over-50s facing a later retirement than they hoped, the Working Lives report nevertheless found encouraging signs that levels of job satisfaction were highest among those aged over 65. A large majority (86%) of private sector workers in that age group said they enjoy their work, compared with just 57% of those aged 18-64. A similar proportion (85%) also said they get a sense of satisfaction from work, while 81% reported being valued by their employer - again, much higher than the younger age groups combined (57%). This backs up the suggestion that there are positive reasons forpeople wanting to stay on at work.

Sources: www.aviva.co.uk (Published article: 2016/03/22)

Suggestions you might not have considered for your bucket list

Bucket lists are, of course, very individual things. We will all have places that we want to travel to and things that we want to do which don't necessarily chime with everyone else's goals. However, bucket lists can also be surprisingly difficult to generate! The things that you really want to do one day might be completely different the next day.Remember being a child in a sweet shop? It's a similar thing when you begin to consider all of the possibilities for one-off events, amazing travel or rewarding experiences.

To help you to think about what you want to do in later life then, here are nine suggestions from us that might inspire some additions to your bucket list.

Complete a significant feat of learning

A lot of people, particularly in later life and middle age, miss the experience of formal learning that they may have had at school and university. With independent, at home or remote learning though, it's still possible to achieve the same rewards available at more formal places of education. Perhaps you want to learn a language, a new practical skill or an instrument. The possibilities for expanding your knowledge still further in later life are varied and vast!

Do something 'extreme'

One for the adventurers out there, many bucket lists feature something some of us would have to be bribed into… or at least strongly convinced! Whether you want to climb one of the world's tallest peaks or throw yourself out of an aeroplane (parachute attached, of course!), considering something extreme can be a good way to break up every day life (for some of us)!

Set foot on every continent

There are lots of travel-based bucket list items and we are sure your bucket list will already have at least a couple on there. Consider this one, though, as a 'starting point' for a varied travelling life. Even if you're well travelled already, have you missed out Asia or Africa? Beginning your retirement travels by making sure you've ticked off every continent can ensure that your wandering bucket list has variety.

Travel through an entire region or country

Another great way of gaining knowledge whilst on your travels, you may have a specific trip in mind that would work for this item, or you may need to look at some of the famous 'great treks'. How about making it through every state in the USA? Or travelling through the Amazon? Or hopping around the Pacific islands? The possibilities for great trips (which take in some unknown places) are endless and hugely rewarding.

Complete a feat of physical endurance

Many people have some form of physical feat on their bucket list, be it a marathon, a long cycle ride, a mountain climb as mentioned above or a series of those events built into some sort of 'ultra'-style endurance event. It doesn't have to be that big to be significant to you though! If you're not a regular wearer of running shoes then completing a 5K or 10K race can be just as rewarding. Don't be put off by all of these ultra-fit marathoners!

Do something romantically mundane

Lots of people wish that their bucket list could feature just a few things that are a bit more personal to them. After all, thousands of people visit the Great Barrier Reef every year! Think about small things which you'd like to do which will always be personal to you in how they are achieved. Some popular list items in this section include sleeping out under the stars, building your own home, showering under a waterfall and sending a message in a bottle.

Complete a major sub list of your bucket list

A bucket list can seem more achievable if you break it down into smaller parts. If you're interested in art then maybe a good sublist would be to attend every major gallery in the world. Seeing every UNESCO world heritage site is another popular entry. Perhaps you have a list of famous films or plays you'd like to see and experience. These smaller lists can also help your bigger list. Just think how many experiences you'll have and places you'll see when you complete the UNESCO list!

Create something

One for the 'makers' out there; many people want to create something themselves as part of their bucket list. What form this takes will depend on your individual skillset, or current learning path. Perhaps you want to build a kit car. Those good with words might want to write a book. Artists may want to sell a piece of their own work (now more than possible with the advent of websites such as Etsy.com and Notonthehighstreet.com). Like learning something new, this bucket list item can make for an incredibly rewarding and enriching later life.

Time a bucket list event perfectly!

Arguably the Holy Grail of anyone who has thought properly about their bucket list, timing a bucket list event perfectly can be extremely rewarding and can help you to tick off more of your list in one go than you perhaps thought possible. For example, there are stories of bucket listers travelling to the World Cup in Brazil in 2014 and then going on to Peru to tick off Machu Pichu (and with it the South American continent). There are even some stories of travellers turning up in Rio for carnival in February and staying around South America until the tournament began in mid-June! Now that's a truly epic bucket list trip!

Finding Funding for SME start-ups

Whether you're a start-up seeking your initial capital or you've just taken on a small business and are looking for money to grow, you'll need that initial injection of funds to turn your ideas into a reality. According to statistics from Companies House, Britons are embracing the entrepreneurial spirit. Research from the national enterprise Start-up Britain last year showed that 2014 broke the record for the number of new businesses. Their research showed that 581,173 businesses registered with Companies House last year, up from 526,446 in 2013.

However, for entrepreneurs with a viable idea or existing business venture it might not seem easy as small business loans are increasingly hard to come by and new entrepreneurs are often rejected. So what can new owners of SMEs do? Putting your business plan in place, you should explore the options for funding available to you. Here's a guide from 'Small Business' to finding that funding.

- The DIY approach

Otherwise known as 'bootstrapping', it is often the case that small businesses have to self-fund their entrepreneurial projects until other options become more readily available.

In most cases, traditional funding will be difficult to come by for start-ups until they can turn a solid profit. Investing your own money lets future investors know how serious you are about your business.

If you are thinking about starting or taking on an existing business you should already have some money set aside. However, there are also other things worth considering, such as savings accounts, zero interest credit cards and the leveraging of your other assets.

- Friends and family

Friends and family are a very popular and effective funding option as they are more likely to believe in you, your vision and your abilities than an outsider. Naturally you are comfortable around your loved ones, so it can be tempting to over-borrow. Only borrow as much as you need to get your business off the ground and structure your loan repayments to avoid disputes.

The only downfall with this option is the mixing of personal life and business. If things turn sour you could be putting at risk personal relationships and it could end up costing you more in the long run. Make sure you consider the pitfalls and potential risk factors. The risk is high, but the returns can be too, so it's up to you to weigh it up.

- Angel investors

According to the UK Business Angels Association, angel investing is 'the most significant source of investment in start-up and early stage businesses seeking equity to grow their business'. Even some of the world's most reputable businesses like Google, Facebook and Twitter have been on the receiving end of the angel investor scheme.

Angel investors are entrepreneurs who have already been successful, made their fortune and want to invest their money back into start-ups. The investor provides equity finance in return for shares in the business, providing it with money to grow. However the benefits can go way beyond just the finances as their experience and connections are often invaluable.

- Crowdfunding

Crowdfunding has become a popular option among start-ups; Kickstarter, Indiegogo and Fundable to name a few. Last year alone 22,252 projects were successfully funded through Kickstarter and $529 million was pledged (that's over $1,000 a minute).

Supported by the public through their own personal funds, businesses can pitch their idea and the public decide how much they want to contribute. The public input often has an influence on the ultimate value of the product and in some cases the pledgers become shareholders, contributing to the development and growth of the project over time. Currently most crowdfunding pages use a reward based model; rewarding those who invest in the project (often with the product that is going to be produced).

So when considering your funding options, don't forget that there's a wealth of opportunities aside from the traditional start-up loan - what will you choose?

Personal savings shortfall? The state pension may not be the answer to bridging it.

The typical working over-45 year old faces a £8,955 annual retirement income gap based on their current savings and investments - meaning they will rely heavily on a state pension that will still leave them short, the latest Aviva Real Retirement Report shows.

The report reveals that over-45s, who are not yet retired, typically expect to need an annual income of £12,590 from their savings and investments when they retire. But Aviva's analysis shows their typical current savings and investments only amount to £53,793, which would deliver income of £3,117 a year if an annuity is bought or £3,635 each year if invested in a drawdown plan over 25 years. This means the typical person only has enough private savings to finance 29% of their target income: leaving them with a potentially crippling £8,955 retirement income gap every year before the state pension is taken into account. Today's average state pension income of £6,656 would bring their annual shortfall down to £2,299 in retirement. It means that the typical person is relying on the state pension to fund more than half (53%) of their expected retirement income. Despite the shortfall, 43% of working over-45s feel they are financially fit to retire.

Aviva's findings are especially concerning for those over-45s who are closer to retirement and have less of a window to grow their savings. Worryingly, 29% have not even thought about how much retirement income they will need. Those aged 55-64 are more likely to have neglected the issue (34%) than 45-54s (21%) - despite having less time to act.However, Aviva's analysis offers hope to over-45s by showing how a modest boost to savings habit can help them build an extra pot of £42,000: an amount which, in today's money, would bridge the remaining £2,299 retirement income gap once the state pension is added to their existing funds.

With auto-enrolment only just reaching smaller companies, two in five over-45s have a company pension (43%). Fewer still have a personal pension or SIPP (30%); far below the 82% with current accounts and 70% with savings accounts. Having savings accounts, ISAs and company pension savings are key indicators of feeling confident about retirement finances. ISAs contribute 11p for every £1 saved by over-45s, but again less than half (46%) use this method of saving. Buy-to-let (BTL) property contributes 19p in every £1 overall: almost as much as ISAs, savings accounts and current accounts combined (20p). But this is an expensive venture: among those who have a BTL property, the typical investment is £126,440.

Clive Bolton, Managing Director of Retirement Solutions, Aviva UK Life, said:

These findings should encourage every person still in work to think hard about their retirement finances and which group they fall into: the reasonably fit to retire, the potentially fit to retire or the currently unfit to retire. The pension freedoms have broadened people's financial options in later life - but they don't guarantee freedom from responsibility when it comes to better planning and improving savings habits.

As things stand, the vast majority of people are in danger of being left short-changed by insufficient savings pots, but with the addition of the state pension, the gap is narrow enough to enable them to take action to close it completely.

Finding additional ways to supplement their savings, such as increasing pension contributions while they are in work, working for longer or taking on a part-time job in retirement, may be enough to help them reach their target income.

Tackling the retirement income shortfall - what should consumers consider?

- Understand what your total savings pot will provide as retirement income and how this measures up to your expectations.

- Consider the diversity of your investments - could you get better returns by spreading your money around more?

- Commit to pensions and make the most of personal and employer contributions.

- Consider steps you can take to increase your savings - whether it is increasing pension contributions, working for longer, or taking on a part-time job in retirement.

- Take an active interest in how your savings and investments are performing - don't let apathy rule your future.

- Act sooner rather than later to adjust your strategy and contribute more whenever you can.