Beaufort Financial Pathfinder is an independent Financial Adviser that offers sophisticated and transparent financial advice to individual clients and private companies.

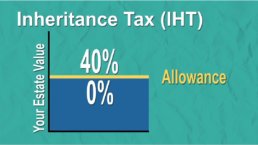

Making plans today to ensure your wealth and assets remain in your family, with future inheritors being protected, is what we refer to as estate planning. Inheritance tax (IHT) planning becomes part of the wider estate planning exercise.

Beaufort Financial is here to help you plan in several ways:

- Working with your other professional advisers (solicitors/accountants) to optimise the estate and tax-planning aspects of your Will

- Advising you on the various tax implications involved in giving lifetime gifts

- Reviewing your pension provision and suggesting ways to improve its role in your estate planning

- Arranging investments and life assurance to help reduce or fund IHT

- Helping you to understand how trusts work

- Advising you on any relevant insurance or protection plans to cover you, should you need

- Reviewing your current protection/insurance policies.

We can help you find the best solution, that’s right for your situation. We also offer a free no-obligation initial consultation to discuss your financial needs.