Autumn Budget 2017: Were you a winner or a loser?

Every Budget has winners and losers; with some people faring better than others.

So, how did you fare? Read on as we reveal whether you are a winner or a loser after Philip Hammond's second Budget of 2017.

Winners

First-time buyers

Those buying a home for the first time will now benefit from the abolishment of Stamp Duty on homes up to the value of £300,000. To ensure that this can help first-time buyers in high value areas, such as London, the first £300,000 will be exempt from Stamp Duty on homes above this value to a maximum of £500,000.

The Chancellor said that this would mean: A Stamp Duty cut for 95% of all first-time buyers who pay Stamp Duty.

Under 30s who travel by train

The 16-25 railcard will now be available to people aged up to 30. The so-called 'Millennial Railcard' will be available next year, and will offer savings of up to a third off non-peak fares.

Whilst the railcard won't provide savings for regular commuters travelling in peak times, it will benefit people travelling at less busy periods.

People claiming Universal Credit

Measures will be put in place to support those claiming Universal Credit, such as the removal of the seven-day waiting period for benefit claims. This means that benefits will be paid on the day of the claim, giving families access to money for rent payments. Advances will also be able to be applied for online, and the repayment period for advances will increase from six to 12 months.

Any new claimant in the receipt of housing benefits will continue to receive them for two weeks, meaning that benefits aren't lost in the crossover period.

People earning the National Living Wage

The National Living Wage will be increased by 4.4%, rising from £7.50 per hour to £7.83 per hour. This will take effect from April 2018.

Taxpayers

From April 2018, the tax-free Personal Allowance will be increased from £11,500 to £11,850.

The higher rate threshold will be increased from £45,000 to £46,350.

People saving into pensions

For once we had a Budget where no changes were announced to pension tax-relief or allowances.

Drinkers

The duty on ciders (except white cider), wines, spirits and beer will be frozen, meaning those buying alcoholic drinks will see no price increase next year.

Air passengers

From April 2019, short-haul Air Passenger Duty rates and long-haul Air Passenger Duty rates will be frozen. This will be paid for by an increase on Premium class tickets and private jets.

Drivers

The scheduled fuel duty rise for both petrol and diesel vehicles in April 2018 has been cancelled. This is expected to save a typical driver £160 per year.

Small businesses

The VAT threshold for small businesses has been maintained for the next two years at £85,000.

A planned business rate switch from RPI to CPI has been brought forward by two years, to April 2018. This is expected to reduce the burden of business rates by an extra £2.3 billion.

Pubs

A £1,000 business rate discount will be made available to pubs with a rateable value of less than £100,000 for one more year, to March 2019.

Homeless people in the West Midlands, Liverpool and Manchester

A £28 million pilot scheme will aim to tackle the problem of people sleeping rough in the West Midlands, Manchester and Liverpool.

House builders

Over the next five years, £44 billion in capital funding, loans and guarantees will be allocated to deliver 300,000 new homes per year. This includes £1.5 billion to help smaller firms build more houses.

GCSE computer science students

The number of trained computer science teachers will be tripled to 12,000, with the aim to place a fully qualified GCSE computer science teacher in every secondary school.

Anybody charging their electric car at work

A new £540 million charging infrastructure fund will support the growth of electric cars. This will provide more charging points, especially at places of business.

New tech businesses

£20 billion of new investment has been unlocked for UK-based businesses in the technology sector. This consists of a new fund of £2.5 billion that has been allocated for emerging UK businesses, designed to replace European investment funds post Brexit.

Losers

Economy

The Chancellor started his speech by revealing a series of forecasts showing growth in the economy is expected to be significantly lower than predicted earlier in the year.

Diesel car drivers/ businesses

Drivers of diesel cars, which do not meet the latest pollution standards, will see their Vehicle Excise Duty (VED) rise by one band in April 2018.

The existing diesel supplement in company car tax will rise by 1%, the proceeds from which will be used to create a new £220 million Clean Air Fund.

Premium and private air travellers

Increase in prices for premium and private air travel to compensate for a freeze on duties for short-haul air passengers and long-haul economy air passengers.

Employers

The National Living Wage for those aged 25 and over will rise by 4.4% to £7.83 per hour from April 2018.

Smokers

The duty on tobacco, hand-rolled tobacco and the minimum excise duty on cigarettes, which is due to be introduced in March, is set to rise by 2% above the Retail Price Index (RPI) inflation.

People selling their business

Freeze for indexation allowance on Capital Gains Tax. Companies will receive relief until January 2018.

Empty property owners / investors

Local authorities will be given the power to charge a 100% council tax premium on empty properties.

Here to help

If you have any questions about today's Budget please call us on the usual number; we are here to help.

Autumn Budget 2017: Everything you need to know

The Chancellor, Philip Hammond rose to his feet at 12.38 to deliver his second Budget of the year.

The days leading up to the Budget have been dominated by talk of housing, Universal Credit and, most surprisingly, rail cards.

Mr Hammond started in a bullish and optimistic mood, saying: I report today on an economy that continues to grow, continues to create more jobs and continues to confound those who seek to talk it down. He then turned to Brexit, saying that the UK will be prepared for every possible outcome of the current negotiations.

As convention dictates, the Chancellor then moved on to the latest economic data and forecasts for the years to come.

The economy

The Chancellor confirmed that:

- Gross Domestic Product (GDP) has been substantially revised down, and is now predicted to grow by 1.5% in 2017, 1.4% in 2018, 1.3% in 2019 and 2020, 1.5% in 2021, 1.6% in 2022

- Inflation, as measured by the Consumer Prices Index (CPI), will peak at 3% in this quarter, while the Bank of England's inflation target will remain at 2%

- Borrowing will continue to fall in years to come, to reach its lowest level in 20 years in 2022 / 23 when it will be £25.6 billion. This year, borrowing is predicted to be £49.9 billion; £8.4 billion lower than forecast in the Spring Budget

He then moved on to a raft of announcements.

Research and Development (R&D)

Mr Hammond said: "We are allocating a further £2.3 billion for investment in R&D (research and development) and we'll increase the main R&D Tax Credit to 12%."

Tech businesses

The Chancellor said that a new tech business is founded in the UK every hour; he said he wanted that to be every half hour.

To help achieve that aim, Mr Hammond unveiled a range of measures, including a new public fund and an improvement in EIS (Enterprise Investment Schemes) tax-relief for investments made into 'knowledge intensive' companies.

Cars

It was announced that people who drive an electric car, and charge it at work, will not face benefit-in-kind tax charges. Furthermore, a £400 million charging infrastructure fund was also unveiled.

Older diesel cars will face higher road-tax. Although Mr Hammond was keen to point out that no white van man or white van woman will have to pay the increase.

Environment

Referencing the BBC's Blue Planet programme, Mr Hammond announced that the Government will explore new taxes on plastic waste.

Education

Mr Hammond announced measures to promote maths teaching in schools, including a £600 payment to schools and colleges for each child who studies A-Level or core maths.

Universal Credit

Mr Hammond said that Universal Credit was a necessary and long-over due reform, where work always pays and people are supported to earn.

However, he went on to announce several key changes:

- The seven-day waiting period will end

- The system will change so that households can get an advance for a full months' payment within five days

- People claiming an advance will now have 12 months to repay it

Mr Hammond said this was a £1.5 billion package to help people with the change to Universal Credit.

National Living Wage

The National Living Wage, for people aged 25 or over, will increase from £7.50 to £7.83 from April 2018; a £600 per year rise for full-time workers.

Income Tax

Mr Hammond announced that from 6th April 2018 the Personal Allowance, the amount which can be earned before income tax is paid, will rise to £11,850 from £11,500 in the current tax year .

The higher-rate tax threshold will also rise to £46,350 from the same date.

No changes were announced to the rates of Income Tax.

Alcohol & tobacco

Duty will be frozen on wines, spirits, cider (except white cider) and beer.

The cost of tobacco will rise by inflation, plus 2%.

Travel

A new railcard for people aged 26 - 30 will give a third off rail fares.

The Chancellor also announced that the scheduled rise in fuel duty, due to take effect in April 2017, will be cancelled.

Also, short-haul Air Passenger Duty will be frozen. However, there will be an increase on premium class tickets and private jets.

NHS

Mr Hammond spoke of the Government's commitment to the NHS.

He then announced an additional £10 billion of capital investment, as well as £2.8 billion, day-to-day funding over next three years.

Corporation Tax

The Chancellor announced no changes to the rates of Corporation Tax.

Business owners

Mr Hammond said: "There is a case now for removing the anomaly of indexation allowance for capital gains - bringing the corporate system into line with personal capital gains tax. I will therefore freeze this allowance."

This measure will increase the tax bills paid by people selling their business.

Pensions

Despite the usual speculation, and for the first time in many years, the Chancellor announced no significant changes to pension legislation, tax-relief or allowances.

There's no doubt that will come as a relief to those people using pensions to plan for their retirement.

VAT (Value Added Tax)

Despite pre-Budget speculation, the Chancellor announced that the VAT threshold will remain frozen at £85,000 for the next two years.

However, a consultation on the structure of VAT was also announced.

Small businesses

The way in which business rates are increased each year will change.

From 2018, they will now rise in line with CPI (Consumer Prices Index) and not RPI (Retail Prices Index) saving £2.3 billion.

Housing

In perhaps the largest section of his speech Mr Hammond said: Getting on the housing ladder is not a dream of your parents' past but a reality for your future.

He then outlined some of the Government's accomplishments, but was clear that there is more to do to increase house building and help younger people onto the housing ladder.

Mr Hammond announced a £44 billion package of funding, loans and guarantees to help the housing market.

He also announced local authorities will now have the power to charge a 100% Council Tax premium on empty properties.

Finally, new measures to combat homelessness and rough sleeping were also announced.

First time buyers

The Chancellor announced that, from today, Stamp Duty will be abolished for all first-time buyer purchases up to £300,000.

To help first-time buyers in high price areas no Stamp Duty will be payable on the first £300,000 on property purchases up to £500,000. This is a stamp duty cut for 95% of all first-time buyers who pay stamp duty.

Here to help

If you have any questions about today's Budget please call us on the usual number; we are here to help.

Interest rate rise: How will it affect you?

It's taken more than 10 years, but it's finally happened.

The Bank of England has decided to increase interest rates with the Monetary Policy Committee (MPC) voting by 7-2 to increase base rate from 0.25% to 0.5%, principally in response to inflation hitting 3%.

The rise was modest, not that you would have thought so from the acres of coverage it got, and only takes rates back to where they were in August last year. However, with inflation stubbornly above target, it is probably a sign of things to come.

As the hysteria dies down, it's only natural to ask: how will this affect you? And, when can we expect further rate rises?

How will you be affected?

Homeowners with a variable rate mortgage: If you are one of the 3.7 million (Source: Bank of England) people with a mortgage arranged on a variable or tracker rate, you can expect to see your payments rise.

Over the coming weeks your bank or building society will be in touch to let you know how much more your mortgage will cost each month.

Homeowners with a fixed rate mortgage: Those people with a fixed rate mortgage won't be immediately affected by the rate rise. However, when their current mortgage deal comes to an end, the products available will reflect this, and any subsequent increases.

People with unsecured debt: The increase of 0.25% is relatively insignificant compared to the interest rates charged on some unsecured debt, especially credit cards and payday loans. Furthermore, the average interest rate charged on a personal loan is just 3.7%, half that of 10 years ago (Source: BBC).

However, it should serve as a wake-up call for those people with large amounts of unsecured debt; with further rate rises expected, now is probably the time for consumers to consider reducing their indebtedness.

Savers: Mark Carney, the Governor of the Bank of England, made it clear he expects the rate rise to be passed on to savers in full. However, such a modest rise will do nothing to bring a real return, where the interest rate exceeds inflation, any closer for savers.

Future pensioners: Although less popular than in years gone by, anyone planning to use an Annuity to turn their pension into an income can expect rates to rise slightly as a result of the increase to interest rates.

When can we expect further rate rises?

Mark Carney isn't known for the accuracy of his crystal ball. However, he believes interest rates will have to rise twice more over the next three years.

The uncertainty over Brexit, inflation and the wider economy means this prediction must be treated with some scepticism. However, it's clear that if inflation continues to remain above the Bank's target of 2%, interest rates will have to rise further.

No need to panic

The increase of 0.25% is modest and won't, immediately at least, affect anyone with a fixed rate mortgage.

However, there's no doubt it's symbolism or that it is potentially a sign of things to come. That means mortgage borrowers, many of whom will have never seen an interest rate rise, should start to prepare for future rate rises.

If you are considering your mortgage and lending options in light of this rate rise, Beaufort Capital Solutions is a new, dedicated financial solutions service, designed for the exclusive use of Beaufort Group partners and professional connections; providing assistance across a vast range of financial requirements for clients; from residential, to commercial, to business finance - on an advised or referred basis.

For more information, please visit:www.beaufortcapitalsolutions.co.uk

Beaufort Securities

There have been a number of extremely negative trade press stories recently regarding an investment company called Beaufort Securities. Formerly a stockbroking business called Hoodless Brennan, Beaufort Securities has been censured by the Financial Conduct Authority on a number of occasions and is no longer trading as a Discretionary Fund Manager.

We would like to reassure our clients and professional partners that Beaufort Financial has no association whatsoever with this company. Given the similarity of the name, we would recommend that you check the full company name of any emails you receive from any firm purporting to be Beaufort.

If you have any concerns or queries, please do contact us.

Update on state pensions: essential reading for the under 50s

Recent changes announced by the government to the state pension will result in nearly six million people currently in their forties having to wait longer until they can retire. It's a development which has raised concerns over the dependability of the state pension, which for many makes up the lion's share of their retirement income and is the most valuable state-funded perk for even more people.

For the seven decades between 1940 and 2010, the state pension age remained constant for both men (65) and women (60). However, thanks to the 1995 Pensions Act, the age for women was increased to 65, a change which was to be phased in between 2010 and 2020. This was then altered further when the Conservatives and Liberal Democrats formed the coalition government in 2011, speeding up the process so that the age for women would increase to 65 between April 2016 and November 2018, with a further increase to 66 for all working adults from April 2020.

Under these plans, the state pension age would be 68 for those born after 6th April 1978. But the changes announced in July this year mean that window will increase to include those born between 6th April 1970 and 5th April 1978. The pension age for anyone currently under 39 is yet to be confirmed. The changes are likely to affect the younger generations who have lost out through the closure of 'final salary', or 'defined benefit' pension schemes.

Those in their late 30s and 40s are being described as the 'sandwich generation', being as they've missed out on the final salary pension schemes enjoyed by older generations, but are now too far through their working lives to feel the full benefit of automatic enrolment which younger generations will experience.

However, there are further concerns that things could change yet again, as the government has stated that law on the proposed pension changes won't be passed until 2023, essentially preparing to pass the legislative aspects on to a future government. Thanks to Theresa May's weakened position and Labour's opposition to the proposed increases to state pension age, the changes may not happen at all.

As such, there have been calls from those in the financial world for an independent body to oversee any future changes, as well as the establishment of a national savings strategy to help people with their savings and investments to provide for their future.

Sources

Telegraph

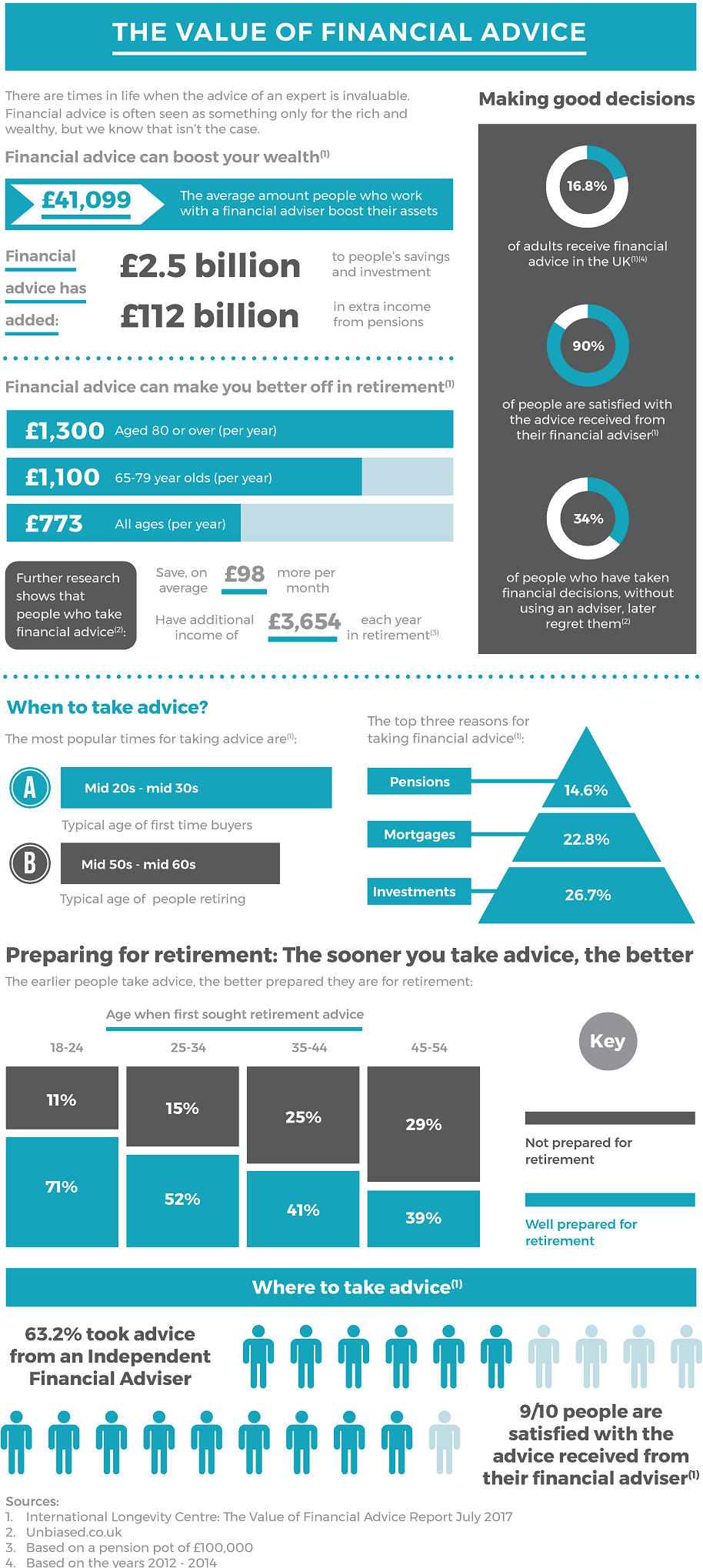

Infographic: The value of financial advice

There are time in life when the advice of an expert is invaluable. Financial advice is often seen as something only for the rich and wealth, but we know that isn't the case.

Click here for a copy of the value of advice infografic or a printable copy here.