Beaufort Financial Plus is an independent Financial Adviser that offers sophisticated and transparent financial advice to individual clients and private companies.

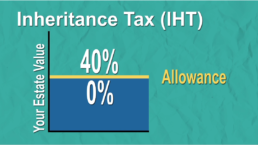

Making plans today to ensure your wealth and assets remain in your family, with future inheritors being protected, is what we refer to as estate planning. Inheritance tax (IHT) planning becomes part of the wider estate planning exercise.

Beaufort Financial is here to help you plan in several ways:

- Working with your other professional advisers (solicitors/accountants) to optimise the estate and tax-planning aspects of your Will

- Advising you on the various tax implications involved in giving lifetime gifts

- Reviewing your pension provision and suggesting ways to improve its role in your estate planning

- Arranging investments and life assurance to help reduce or fund IHT

- Helping you to understand how trusts work

- Advising you on any relevant insurance or protection plans to cover you, should you need

- Reviewing your current protection/insurance policies.

We can help you find the best solution, that’s right for your situation. We also offer a free no-obligation initial consultation to discuss your financial needs.

Videos

Sign up to our newsletter

Read our monthly newsletter full of useful financial tips and advice.

Simon was able to give me clear, well-informed advice about my situation and enabled me to make a decision about my funds that gave me long term protection. A very good outcome, at a time when I really need good financial advice. S, Ray. Bristol

Simon has provided sound financial advice for many years for myself and my family, his ability to explain complex financial options clearly has enabled me to make informed decisions regarding investment strategies and how best to secure my retirement. N, Lambert. Bradley Stoke

We've used Simon a number of times over the years for remortgage, pension, investment and general financial advice. He is very knowledgeable but easy to talk to and automatically puts you at ease. He explains things clearly and concisely and is always available at the other end of the phone, he is very generous with his time which is a rarity. His advice has enabled my partner and I to move forward on to the next stage of our lives and plan for our future together as a family.J, Miller. Reigate

Simon has been my financial advisor for over seven years. He initially advised me on investments after the death of my husband. He regularly updates me on various things and is always careful to check on my preferences and help me to make suitable choices. He is always available for any queries and has given me good advice when asked for it.C, Cooper. Great Missenden

We have been with Simon for just over a year, and have found him to be knowledgeable, professional and very quick to respond. He has created a lifetime financial tracker for us which we now update as and when our finances change, and this allows us to predict what our future financial position will be which is extremely useful as we both plan to scale down our full time employment in the next couple of years. M, Eva. Knaphill

Simon is friendly, professional and helpful. We’ve been pleased with his financial advice. He has an in depth knowledge and is quick to respond. Most importantly we’ve felt a level of trust and integrity. S, Eva. Knaphill

My wife and I have been customers of Simon Brannigan since 2002 when I decided to take early retirement. I attended a seminar which he conducted on financial issues. Since then he has efficiently masterminded and advised on all our financial issues - my pensions, mortgages, investments, wills, power of attourney, the sale of a property, tax advice and allowances. He has always responded quickly to any issues we have raised - finding time to visit for discussion, or sending a helpful email.E.T, Holdaway. Weston-Super-Mare

I have used Simon Brannigan for financial advice over many years, including mortgage advice, investments, life insurance, powers of attorney, wills, and inheritance. I have always found him very friendly and interested in whatever issue I have presented him with. He is very knowledgeable and thoroughly explains the advice he gives in layman’s terms.N, Eades. Weston-Super-Mare

Simon Brannigan has dealt with my complex financial matters for the last twelve years. Everything is clearly researched, explained and followed through. He has dealt with inheritance issues, lifetime and lifestyle planning, pensions, investments, life insurance and mortgage arrangements. K, Pollard. Marlborough

Simon's knowledge in the area of retirement and pensions is the best I have found and I have talked to 6 other advisers. He has a new system which is called Your Financial Future. He has shown me how to retire successfully. M, Knight. Winterbourne

I have been with Simon for some 5 years and he is easy to engage with, prepared to answer my questions and research matters of financial interest to myself. His advice has always been in tune with my risk profile and with his assistance I have watched my investments, savings and pensions grow.D, Lowin.

Simon is professional, courteous, friendly, informative and honest. He presents various options with clarity and without bias and carries out his work without delay. We are using Simon to enable us to organise ourselves properly to achieve the retirement goals of my wife and I, while also saving for our child via a consolidated pension plan and other savings plans. Dr. S Benham. Bristol

Good clear advice and the patience to explain to the less pension savvy of us exactly what the options, risks and rewards may be.I, Jones.

My partner and I used Simon to help with our finances, as we have just moved into our first house. He was very professional, explained everything in a way that we understood.C, Alsop.

I knew that the complexities of our situation meant I needed help in finding a product to meet our needs, and asked Simon for help. He instilled confidence and demonstrated his vast experience knowledge from the outset. He is efficient, friendly, honest and has worked hard to find us a solution.S, Twigger.