Beaufort Analysis No. 247 – It’s all about the money

Last Thursday, members of the Bank of England’s Monetary Policy Committee voted 7-2 to keep interest rates on hold at a record low of 0.25%, but the Committee was talking in much stronger terms about an increase due to higher inflation and a pick up in growth. Earlier in the week, it was reported that inflation had risen to 2.9% in August, from July’s reading of 2.6%, further affecting household finances. As well as the rising price of oil, inflationary pressures were the most apparent in clothing and footwear, largely because of retailers’ rising import costs due to the fall in sterling following the EU referendum.

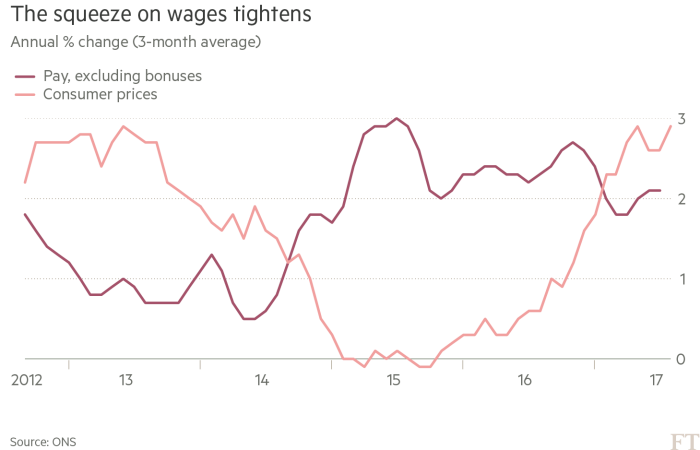

UK unemployment fell by 75,000 in the three months to July, bringing the jobless rate down to 4.3%, its lowest since 1975, but a squeeze on real incomes continues. According to the Office of National Statistics, wages during the period increased by just 2.1%. This fall in real wage growth, coupled with a strengthening economy and an expected decline in inflation after October, is acting as a check on any push for an interest rate rise. The Bank’s rate decision and an agreement from the majority of Committee members that some withdrawal of monetary stimulus is likely to be appropriate over the coming months lifted the pound to its highest level against the dollar since the Brexit vote.

In the markets, the week got off to a positive start as concerns over the fall out from Hurricane Irma abated and the fear of tensions with North Korea were put to one side. However, the latest missile test, as well as the strengthening pound affecting overseas earnings, dragged the FTSE 100 index to close more than 2% lower on the week. It was nevertheless, a record-breaking week for the US markets and all three main indices reached all-time highs on Wednesday.

Finally, the new polymer £10 note entered circulation on Thursday; its paper forerunner being withdrawn next spring. Meanwhile the old one pound coin, which has been in circulation since 1983 (prior to the launch of the FTSE 100 index), will be withdrawn on 15th October.

*Image courtesy of Bank of England. Mark Carney – Governor, Victoria Cleland – Head of Notes Division, Chris Salmon – Executive Director for Banking Services and Chief Cashier.