Debunking the Critical Illness Cover myth

Do Critical Illness Cover plans pay out when you make a claim?

The media loves a story involving refusal to pay out on insurance claims. Those cases are highlighted to cause a reaction and as a result, the public perception of Critical Illness Cover has been distorted. Fortunately, the media's portrayal of insurance not paying out is more myth than fact.

In 2016, statistics provided by the Association of British insurers (ABI) showed that a record 15,646 Critical Illness Cover claims were successful last year.

What is Critical Illness Cover?

Critical Illness Cover is an insurance policy which:

- Pays out a tax-free amount. This is generally a lump sum which is paid out if you are diagnosed with a life-threatening illness, such as cancer, heart attack or stroke

- Policies last for a specific period, often equal to the length of your mortgage and usually pay out a lump sum which is slightly above the value of your mortgage

- Can be combined with life insurance in certain cases

- Covers a set list of severe illnesses, which differs with each policy

The cover's specific terms and conditions will vary depending on the policy and provider.

What are the true figures?

Insurers paid out in an average of 92.2% of all cases in 2016. Individual examples include:

- Aviva 92.3%

- Aegon 95%

- Vitality life 93%

- Legal & General 92.6%

- AIG 92.3%

- Royal London 92.2%

- LV= 92%

People perceive insurance policies as not paying out fairly, with data from Aviva showing that as many as 86% of adults believe that insurers purposefully try to void claims. The same research suggests that UK adults believe that insurers only pay out in around 48% of cases.

In reality, less than 10% of claims do not result in a pay-out, for a range of reasons.

Why do some claims fail to pay out?

There are two main reasons for failed insurance claims:

- Non-disclosure. Where applicants fail to provide accurate information

- Not meeting criteria. Where claims do not meet the requirements laid out in the policy

Research from Aviva shows that many UK adults are not taking insurance policies seriously, which leads to a refusal to pay out when a claim is made. The research showed that:

- 53% of policy holders have not read the details of their insurance policy

- 54% only check the terms and conditions when they need to make a claim

- 45% do not think that supplying incorrect height and weight data affects their claim

- 25% do not think that lying about their smoking and alcohol consumption will affect their claim

- 26% of people have given false general health information, while 31% have not accurately stated their family's medical history on applications

- 33% admit to being dishonest in insurance applications

Only 10% of claims fail, and with the figures showing that many of those are a result of applicant and claimant negligence, it is time that the importance and effectiveness of Critical Illness Cover is fully explored.

Improving the success rate

To ensure that your Critical Illness Cover will pay out when you need it to, there are three key steps to take:

Find the right policy: When comparing plans, it is important to look at the details. It can be tempting to choose a policy based on price alone. However, this can backfire if the policy doesn't cover a wide range of possibilities or has a clause which will mean that you are exempt, should you need to make a claim.

Be honest when applying: Giving false details during your application will affect your right to claim in the future. Whether it is intentional or accidental, inaccurate data, including height and weight, will void the policy and result in your being turned down if you try to make a claim in the future.

If in doubt, mention it: When taking out any type of insurance, especially Critical Illness Cover, it is important to mention any information and circumstances which may affect your ability to claim. If there are doctor's appointments, tests and diagnoses which you are not sure about mentioning, we advise that you mention it. That way, you cannot be accused of withholding information. Remember, it is better to be turned down for an application now, rather than pay into a plan which will not benefit you.

To discuss your options and find out more about Critical Illness Cover, please call us on the number at the top of this page.

What is an ISA?

An ISA, or Individual Savings Account, is a type of savings or investment account which has significant tax benefits and can be used in a variety of ways.

There are a range of ISA account types, each offering different services and suited to differing needs and circumstances:

Cash ISA

Who can have one?

Anyone over the age of 16.

What is the maximum that can be paid in?

£20,000 per year. 16-17-year-olds are granted an additional £4,000 Junior ISA allowance.

Who is it for?

People who are looking to shelter their savings from tax liability.

Cash ISAs offer a tax-free alternative to standard savings accounts. Anyone aged 16 and over can open a cash ISA and make deposits up to the adult ISA allowance each year, currently this is £20,000

For people aged 16 and 17, an additional junior ISA allowance of £4,000 per year is added to this figure. Cash ISAs generate interest which is tax-free.

Stocks & Shares ISA

Who can have one?

Anyone over the age of 18.

What is the maximum that can be paid in?

£20,000 per year.

Who is it for?

People who are looking to invest their money, whilst sheltering it from tax liability.

A Stocks & Shares ISA is an account through which you can invest in a range of options, including:

- Stocks

- Shares

- Government bonds (Gilts)

- Corporate bonds

- Investment and unit trusts

- Open Ended Investment Companies (OEICs)

Stocks and shares ISAs are available to UK residents over the age of 18 and are significantly riskier than cash ISA's because investment values can rise and fall over time.

Innovative Finance ISA

Who can have one?

UK residents aged 18 and over

What is the maximum that can be paid in?

£20,000 per year

Who is it for?

Those wishing to invest through peer-to-peer lending and crowdfunding new ventures.

As crowdfunding and peer-to-peer lending becomes more popular, the Innovative Finance ISA combines the ability to assist and fund new ventures whilst protecting any gains from taxes.

Innovative Finance ISAs and investments run the risk of losing capital because of borrowers defaulting or failing to make repayments.

Lifetime ISA

Who can have one?

UK residents aged 18-39.

What is the maximum that can be paid in?

£4,000 per year, which is deducted from the annual adult ISA allowance.

Who is it for?

Under-40s looking to save toward a deposit for their first home or retirement funds.

The Lifetime ISA is newly-introduced and is designed to help those aged between 18 and 39 to save towards their future. As a government-backed initiative, savings in Lifetime ISA accounts attract a government bonus of 25%, if the money is used toward a first house deposit, or remains in the account until the owner's 60th birthday and is then used as a retirement fund. Withdrawals can be taken out of a Lifetime ISA, but will be subject to a 25% fee - forfeiting the government bonus, unless used for buying property or for retirement funding.

There is an exception to the withdrawal rule, if the owner is diagnosed with a terminal illness and has a life expectancy of less than one year.

Lifetime ISAs have an annual deposit limit of £4,000 which counts toward the owner's annual personal allowance each tax year.

Help to Buy ISA

Who can have one?

UK residents over the age of 16 who do not own property.

What is the maximum that can be paid in?

- £1,200 within the first month

- £200 per month after that

Who is it for?

First time buyers looking to shelter their deposit savings from tax liability and who wish to take advantage of the government bonus available.

Help to buy ISAs were introduced to assist savers in collecting the deposit for their first property. The account can be opened with an initial deposit of up to £1,200 in the first calendar month, followed by monthly savings of up to £200. When the ISA is closed and the savings are withdrawn to be used as a mortgage deposit, the government will apply a 25% bonus.

The bonus is capped at a £3,000 return on a £12,000 balance, meaning that Help to Buy ISA holders could have a £15,000 deposit saved after 4 Ω years.

For more information about ISAs and how they could help you to protect your savings or work toward your financial goals, get in touch using the phone number at the top of the page.

The Changing Landscape - Regulatory developments affecting Solicitors and Financial Advisers - Free Seminar

We are hosting a free seminar on November 21stin conjunction with SIFA, on regulatory developments that affect how Solicitors work with Financial Advisers. If this is of interest then please register to reserve your place using the link below.

Beaufort Financial St Helens - The Changing Landscape - Regulatory dev…

Beaufort Securities

There have been a number of extremely negative trade press stories recently regarding an investment company called Beaufort Securities. Formerly a stockbroking business called Hoodless Brennan, Beaufort Securities has been censured by the Financial Conduct Authority on a number of occasions and is no longer trading as a Discretionary Fund Manager.

We would like to reassure our clients and professional partners that Beaufort Financial has no association whatsoever with this company. Given the similarity of the name, we would recommend that you check the full company name of any emails you receive from any firm purporting to be Beaufort.

If you have any concerns or queries, please do contact us.

Beaufort Analysis No. 247 - It's all about the money

Last Thursday, members of the Bank of England's Monetary Policy Committee voted 7-2 to keep interest rates on hold at a record low of 0.25%, but the Committee was talking in much stronger terms about an increase due to higher inflation and a pick up in growth. Earlier in the week, it was reported that inflation had risen to 2.9% in August, from July's reading of 2.6%, further affecting household finances. As well as the rising price of oil, inflationary pressures were the most apparent in clothing and footwear, largely because of retailers' rising import costs due to the fall in sterling following the EU referendum.

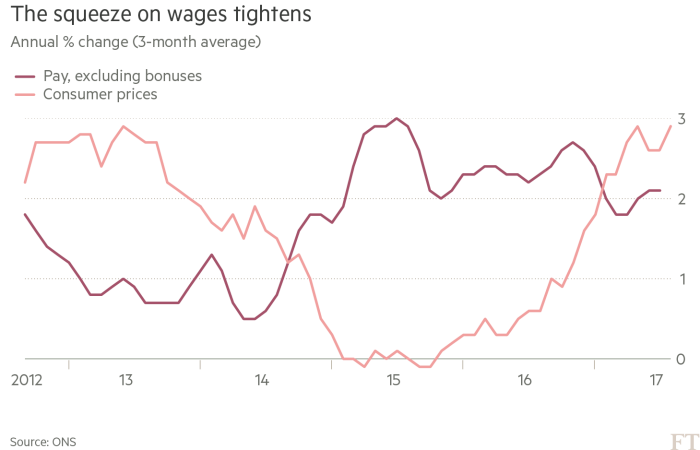

UK unemployment fell by 75,000 in the three months to July, bringing the jobless rate down to 4.3%, its lowest since 1975, but a squeeze on real incomes continues. According to the Office of National Statistics, wages during the period increased by just 2.1%. This fall in real wage growth, coupled with a strengthening economy and an expected decline in inflation after October, is acting as a check on any push for an interest rate rise. The Bank's rate decision and an agreement from the majority of Committee members that some withdrawal of monetary stimulus is likely to be appropriate over the coming months lifted the pound to its highest level against the dollar since the Brexit vote.

In the markets, the week got off to a positive start as concerns over the fall out from Hurricane Irma abated and the fear of tensions with North Korea were put to one side. However, the latest missile test, as well as the strengthening pound affecting overseas earnings, dragged the FTSE 100 index to close more than 2% lower on the week. It was nevertheless, a record-breaking week for the US markets and all three main indices reached all-time highs on Wednesday.

Finally, the new polymer £10 note entered circulation on Thursday; its paper forerunner being withdrawn next spring. Meanwhile the old one pound coin, which has been in circulation since 1983 (prior to the launch of the FTSE 100 index), will be withdrawn on 15th October.

*Image courtesy of Bank of England. Mark Carney - Governor, Victoria Cleland - Head of Notes Division, Chris Salmon - Executive Director for Banking Services and Chief Cashier.