Beaufort Financial Fareham is an independent Financial Adviser that offers sophisticated and transparent financial advice to individual clients and private companies.

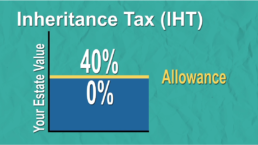

Making plans today to ensure your wealth and assets remain in your family, with future inheritors being protected, is what we refer to as estate planning. Inheritance tax (IHT) planning becomes part of the wider estate planning exercise.

Beaufort Financial is here to help you plan in several ways:

- Working with your other professional advisers (solicitors/accountants) to optimise the estate and tax-planning aspects of your Will

- Advising you on the various tax implications involved in giving lifetime gifts

- Reviewing your pension provision and suggesting ways to improve its role in your estate planning

- Arranging investments and life assurance to help reduce or fund IHT

- Helping you to understand how trusts work

- Advising you on any relevant insurance or protection plans to cover you, should you need

- Reviewing your current protection/insurance policies.

We can help you find the best solution, that’s right for your situation. We also offer a free no-obligation initial consultation to discuss your financial needs.

Videos

Client tax guides

You and yours – estate planning

Estate planning is usually not a subject that attracts immediate attention. It requires you to consider what will happen when your life is over, hardly something most of us rush to contemplate. Consequently, estate planning often becomes a do-it-tomorrow task. Then it could suddenly become all important… or it might be too late.

Financial protection – for you and your family

Financial resilience is the ability to recover quickly from an unexpected financial shock. Many of us insure our homes and cars without really thinking about it, but far fewer insure their lives and incomes. Savings can and do help in the short-term. But what happens when they run out?

Investing for children

Most parents want to help their children financially, whether it is making sure there is enough money for their education or eventually helping them to buy a property. An early objective as they grow up may well be to help children understand the value and importance of money.

Taxation of property

Becoming a landlord has been an attractive proposition for anyone who could raise a deposit, thanks to a prolonged period of low borrowing costs and generally rising property values. Uncertainty in the housing market may reduce property prices whilst capital gains tax (CGT) changes may occur.

Sign up to our newsletter

Read our monthly newsletter full of useful financial tips and advice.

From a business point of view I always feel that you have thought through all the options and thoroughly considered the alternatives before you present them to the client. You give the impression that you have looked at the big picture and put the particular need of your client in context. You understand the overview but always are concerned about attention to detail. You are confident, articulate and apply reasoned, intelligent arguments to explain your case or position.Mrs L, Southampton

We found the presentation very informative and helpful and with the slides of the capital charts you have now provided I feel we can look to the future with some confidence and certainty. Please convey our appreciation to Jon for taking the time to explain how our future might look based on the information we have provided. As you say there are many variables in financial planning but at least we now have a good starting point and a basis for future reviews as and when they become necessary. We like the team approach you adopt for advising clients and your willingness to provide options for consideration at all times. We look forward to a long and successful relationship with you all.Mrs & Mrs H, Wallingford

We have used Jon's financial expertise since selling our business in 2002. Undoubtedly, this has alleviated anxieties regarding taxation, inland revenue notifications and answers to any problematical questions that may have arisen. The cash flow forecasting he does is a reassuring tool ensuring funds for a smooth retirement. The team Jon has grown and evolved around Jon since we have known him and this has only enhanced the business to ensure a seamless client experience. Mrs S, Hampshire

You have the ability to approach everything with confidence, energy & in a very professional manner, being thorough and attention to detail is a strength that is very important to you. You hold trusting relationships with your clients & ensure they receive the best possible service at all times. Mrs K, Fareham